Financial Instruments

Exchange Traded Funds (ETFs): A Complete Guide for Beginners

Nov 30, 2025

When you are exploring investment options, you may come across Exchange Traded Funds (ETFs). ETFs have gained tremendously popular among investors seeking exposure in market diversification, cost-efficiency, and liquidity. But what exactly are these funds, and how do they work? This guide breaks down everything you need to know about Exchange Traded Funds, helping you, as a beginner, to understand their structure, benefits, and how they fit into an investment strategy.

What Are Exchange Traded Funds (ETFs)?

Exchange-traded funds are investment funds that are traded on the basis of stock exchanges, much like shares of individual companies. They track the performance of a particular index, commodity, sector, or even a basket of assets. To put it simply, instead of investing in several individual stocks, an investor can buy one ETF that represents them all. For example, a Nifty 50 ETF replicates the Nifty 50 Index by holding all 50 constituent stocks in the same proportion.

So, what are ETFs? In essence, they are a hybrid between mutual funds and stocks, combining the diversification of a fund with the trading flexibility of a share.

How Exchange Traded Funds Work

To understand how ETFs work, it helps to look at their structure. An ETF is created by a fund house that collects money from investors and invests it in a portfolio designed to mirror an underlying index or asset class.

Each ETF unit represents a proportionate share in that basket of assets. The price of an ETF, known as its Net Asset Value (NAV), changes throughout the trading day as investors buy and sell on the exchange.

Mutual funds can only be bought or redeemed at the end of the trading day, while ETFs can be traded at any time when the market is open. This flexibility is what allows investors to respond to market movements immediately.

Types of Exchange Traded Funds

You will find several types of Exchange Traded Funds based on a specific purpose:

- Equity ETFs: These track stock market indices like the Nifty 50 or Sensex. They are ideal for investors who want exposure to the equity market without picking individual stocks.

- Debt ETFs: These invest in fixed-income securities such as government bonds or corporate bonds. They offer relatively stable returns and are suitable for conservative investors.

- Commodity ETFs: These follow the price of a commodity such as gold or silver. For example, Gold ETFs allow investors to benefit from movements in gold prices without holding physical gold.

- International ETFs: These can provide exposure to foreign markets and indices. It helps investors diversify beyond domestic assets.

- Sector or Thematic ETFs: These focus on investing the capital in a specific industry, such as technology, banking, or energy, offering targeted exposure.

Advantages of Exchange Traded Funds

- Diversification: When investing in a single ETF, investors gain exposure to a wide range of securities. This helps reduce risk because the performance is not dependent on one single stock.

- Cost-Effectiveness: ETFs usually have lower expense ratios than actively managed mutual funds because they passively track an index rather than relying on fund managers to select stocks.

- Liquidity and Flexibility: Since Exchange Traded Funds are listed on exchanges, they can be bought or sold anytime during trading hours, just like shares.

- Transparency: Most ETFs disclose their portfolio holdings every day, allowing you to know exactly what you own.

- Tax Efficiency: ETFs generally have lower capital gains distributions than actively managed funds, making them more tax efficient.

Things to Consider Before Investing in Exchange Traded Funds

ETFs offer multiple benefits, but being a caution investor, here are some factors that you should keep in mind:

- Tracking Error: ETFs aim to track a fund's performance and match their benchmark index, but sometimes the returns may slightly differ due to costs or management efficiency.

- Brokerage Charges: Since ETFs are traded like stocks, buying and selling them involves brokerage fees and other transaction costs.

- Liquidity Risk: Some ETFs, especially those tracking smaller indices, may have lower trading volumes, leading to difficulty in buying or selling units quickly.

- Market Volatility: Like any market-linked investment, ETF prices fluctuate depending upon the movement of the underlying assets.

How to Invest in Exchange Traded Funds

To invest in Exchange Traded Funds, you need a trading and demat account. Once you have one, you can:

- Select the ETF: Choose an ETF that aligns with your investment goal, whether it's equity, debt, or commodity-based.

- Place an Order: You can buy ETF units through your broker during market hours, similar to buying company shares.

- Monitor Performance: Keep track of your ETF's performance relative to its benchmark index and rebalance your portfolio periodically.

Many investors also use Systematic Investment Plans (SIPs) or regular investments in ETFs to average out costs over time.

Are Exchange Traded Funds Right for You?

Exchange-traded funds fit into the financial profiles of a range of investors. Here are some:

- Beginners: They provide a simple way to start building a diversified portfolio without having to analyse individual stocks.

- Experienced Investors: ETFs can be used strategically to gain exposure to specific sectors, geographies, or asset classes.

- Long-Term Investors: For those with a long-term outlook, ETFs offer a cost effective way to stay invested in the market.

However, as with any investment, it's important that you understand all the associated risks and align your choices with your financial goals.

Conclusion

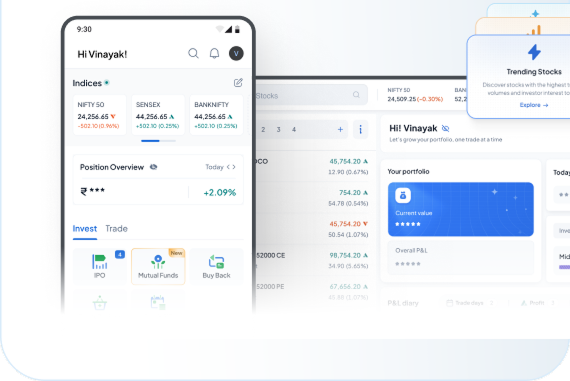

Exchange-traded funds are a middle ground in the market with features of mutual funds and direct stock trading. They are transparent, flexible, and more accessible, making them suitable for new and seasoned investors. Understanding how ETFs work and evaluating your financial objectives can help you make informed decisions. If you're exploring diversified investment options, you can learn more about mutual fund categories and index-based strategies on the Indiabulls Securities Limited (formerly known as Dhani Stocks Limited) website.

Disclaimer

Refer to the Risk Disclosure Document to know the risks associated with F&O Trading.

FAQs

1. Are Exchange Traded Funds better than mutual funds?

Not necessarily. Both have their advantages. ETFs offer real-time trading and lower costs, while mutual funds allow systematic investing without worrying about market timing.

2. Can I invest a small amount in Exchange Traded Funds?

Yes. You can purchase even a single unit of an ETF, depending on its price. This makes it flexible for investors with varying budgets.

3. How do I identify the best ETFs in India?

When evaluating the best ETFs in India, consider factors like tracking error, fund size, liquidity, and expense ratio.

4. Do Exchange Traded Funds pay dividends?

Some ETFs distribute dividends received from their underlying securities, while others reinvest them. Always check the ETF's dividend policy before investing.

Disclaimer: The contents herein are only for information and do not amount to an offer, invitation or solicitation to buy or sell securities or any other financial product offered by Indiabulls Securities Limited (formerly Dhani Stocks Limited / DSL). The content mentioned herein is subject to updation, completion, amendment without notice and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject Indiabulls Securities Ltd. (formerly Dhani Stocks Ltd. / DSL) to any licensing or registration requirements. No content mentioned herein is intended to constitute any investment advice or opinion. ISL disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein. This blog is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made about its accuracy or its completeness is guaranteed. This content mentioned in this blog is solely for informational purpose and shall not be used and/or considered as an offer or invitation or solicitation to buy or sell securities or other financial instruments. ISL will not treat recipients as customers by virtue of their receiving this report. The securities / Mutual Fund units (if any) discussed and opinions expressed in this blog/report may not be suitable for all investors. Such investors must make their own investment decisions, based on their investment objectives, financial positions and specific needs. ISL accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. ISL may have issued other blogs that are inconsistent with and reach different conclusion from the information presented in this blog.

Indiabulls Securities Limited (formerly Dhani Stocks Limited) is a Mutual Fund Distributor registered with ‘Association of Mutual Fund of India’ (AMFI) vide ARN number ARN-160411. Corporate Identification Number: U74999DL2003PLC122874; Registered office address: A-2, First Floor, Kirti Nagar, New Delhi - 110008. Tel.: 011-41052775, Fax: 011-42137986.; Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase - I, Gurugram - 122016, Haryana. Tel: 022-61446300. Email: helpdesk@indiabulls.com