Market Trends

How Macro-Economic Factors Move Indian Stocks?

Jan 21, 2026

The Indian stock market does not move in isolation. While company-specific developments, sector trends, and investor sentiment play a role, the broader economic environment often sets the tone for how markets behave. These wider economic forces, known as macroeconomic factors, influence everything from business activity to consumer spending, which in turn affects the performance of listed companies.

Understanding how these forces shape market movements can help investors make more informed decisions. This blog explores the key macro drivers that tend to influence Indian stock prices and why they matter.

What Are Macroeconomic Factors?

Macroeconomic factors refer to large-scale conditions that affect the economy as a whole. These can include inflation, interest rates, GDP growth, fiscal policies, employment levels and global economic trends. Such factors help paint a picture of the health of the economy and provide a context for interpreting stock market activity.

These are often assessed through various macroeconomic indicators, which measure trends in economic activity. While you cannot control these movements, if you understand them it can help you interpret the shifts that affect the market's performance.

1. Inflation and Stock Prices

Inflation is a closely monitored macroeconomic factor because of the rising prices affect consumers and businesses. When inflation increases, the cost of raw materials, wages and services tends to rise, putting pressure on corporate margins. Higher inflation may also reduce consumer spending, which can weaken the earnings outlook for several sectors.

On the other hand, some industries, such as commodities or energy, may benefit from inflationary environments. Therefore, inflation does not impact all stocks in the same way. Central banks respond to inflation through policy adjustments, which can further influence market direction.

2. Interest Rates and Borrowing Costs

Interest rates also drive market behaviour. The Reserve Bank of India (RBI) sets the standards for policy rates based on inflation and economic growth. If the interest rates are higher, it increases borrowing costs for companies and consumers, possibly slowing economic activity. This may reduce business expansion and put pressure on corporate profits. Conversely, rate cuts may encourage borrowing and spending, which can support market growth. Since interest rates are tied directly to inflation and growth expectations, they remain one of the most important macroeconomic factors to monitor when analysing market trends.

3. GDP Growth and Market Sentiment

Gross Domestic Product (GDP) measures the overall value of goods and services produced in the country. Strong GDP growth often indicates a healthy economy, rising incomes and increased consumption, conditions that generally support corporate performance. When GDP numbers are positive, market sentiment tends to improve.

Slower GDP growth, on the other hand, may signal economic challenges. Such scenarios can trigger cautious investor behaviour and affect stock valuations. GDP is one of the most widely referenced macroeconomic indicators, and its quarterly releases often lead to noticeable movements in the Indian market.

4. Government Policies and Fiscal Decisions

Government actions, such as changes in tax structures, public spending, subsidies and reforms, directly affect the corporate sector. For example, a budget announcement that allocates funds to infrastructure can boost construction, cement and capital goods companies. Policies promoting manufacturing, renewable energy or digital services may drive growth in these respective sectors. Because fiscal policy shapes the broader economic environment, it is considered a significant macroeconomic factor influencing stock performance.

5. Currency Movements and Trade Dynamics

The Indian rupee's movement against global currencies, especially the US dollar. A depreciating rupee can increase import costs but may benefit export-oriented sectors such as IT and pharmaceuticals.

Trade policies, global demand and international supply chain conditions also contribute to how Indian companies perform. These developments are closely linked with macroeconomic indicators like trade balance and foreign exchange reserves.

6. Global Economic Trends

Indian markets react quickly to international events, whether it is changes in US Federal Reserve policy, geopolitical tensions, global inflation or economic slowdowns in major economies. Foreign portfolio investors (FPIs) often adjust their investments based on global risk appetite. Their actions can influence liquidity in Indian markets, amplifying the impact of global macroeconomic factors.

7. Employment Trends and Consumer Demand

Employment levels affect consumer confidence and household spending. High employment generally supports consumption-driven sectors, while weak employment conditions may slow down the demand for certain goods. Since India's economy relies heavily on domestic consumption, employment data can indirectly influence stock market trends.

Conclusion

The Indian stock market reflects a combination of company performance, sector developments and broader economic forces. By understanding macroeconomic factors, investors can better interpret market movements and stay aware of the economic environment shaping stock price behaviour. While these forces cannot be predicted with complete accuracy, staying informed can support more thoughtful financial decisions.

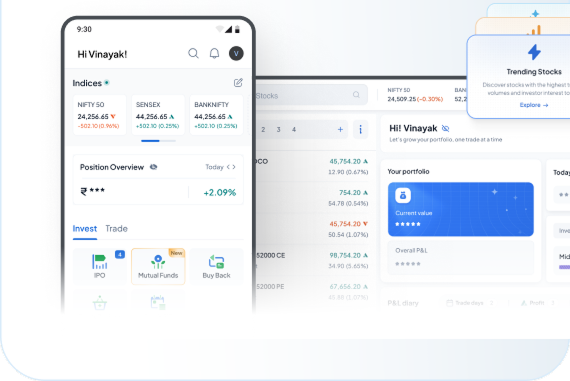

If you'd like to stay updated on market developments and key economic trends, consider exploring the research resources and market insights available with Indiabulls Securities Limited (formerly known as Dhani Stock Limited).

FAQs

1. How often do macroeconomic trends influence stock prices?

Macroeconomic trends can influence stock prices regularly, especially when new data is released or when policy decisions are announced.

2. Do all sectors react the same way to changes in macro conditions?

No. Different sectors respond differently. For example, interest rate-sensitive sectors may react strongly to rate changes, while exporters may respond more to currency movements.

3. Are macro trends predictable?

While economic trends can be analysed, they are not always predictable. Unexpected global or domestic events can cause sudden shifts in market behaviour.

4. Which global factors affect Indian markets the most?

Developments such as US monetary policy, global energy prices and international geopolitical events often have a noticeable impact on Indian market sentiment.

Disclaimer: The contents herein are only for information and do not amount to an offer, invitation or solicitation to buy or sell securities or any other financial product offered by Indiabulls Securities Limited (formerly Dhani Stocks Limited / DSL). The content mentioned herein is subject to updation, completion, amendment without notice and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject Indiabulls Securities Ltd. (formerly Dhani Stocks Ltd. / DSL) to any licensing or registration requirements. No content mentioned herein is intended to constitute any investment advice or opinion. ISL disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein. This blog is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made about its accuracy or its completeness is guaranteed. This content mentioned in this blog is solely for informational purpose and shall not be used and/or considered as an offer or invitation or solicitation to buy or sell securities or other financial instruments. ISL will not treat recipients as customers by virtue of their receiving this report. The securities / Mutual Fund units (if any) discussed and opinions expressed in this blog/report may not be suitable for all investors. Such investors must make their own investment decisions, based on their investment objectives, financial positions and specific needs. ISL accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. ISL may have issued other blogs that are inconsistent with and reach different conclusion from the information presented in this blog.

Indiabulls Securities Limited (formerly Dhani Stocks Limited) is a Mutual Fund Distributor registered with ‘Association of Mutual Fund of India’ (AMFI) vide ARN number ARN-160411. Corporate Identification Number: U74999DL2003PLC122874; Registered office address: A-2, First Floor, Kirti Nagar, New Delhi - 110008. Tel.: 011-41052775, Fax: 011-42137986.; Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase - I, Gurugram - 122016, Haryana. Tel: 022-61446300. Email: helpdesk@indiabulls.com