Financial Planning 101

How to Prioritise Investments When You Have Multiple Goals

Jan 17, 2026

Managing money becomes trickier when you are working towards several financial objectives at the same time. Whether it is saving for a child's education, planning a holiday, building a retirement corpus, or buying a home, you may often find yourself wondering which goal deserves attention first. This is where investment prioritisation helps bring clarity, structure, and balance to the way you way you allocate your money.

In this guide, we break down how you can approach multiple goals without feeling overwhelmed and make decisions that suit your income, lifestyle, and future plans.

Why Investment Prioritisation Matters

When you are young, you juggle several goals, and spreading your money evenly across all of them may not be an effective strategy. Some goals require you to take immediate action, while others let you take your time while saving. Investment prioritisation ensures that you use your resources smartly based on urgency, importance, time horizon, and affordability. It also helps reduce stress as you gain a clearer picture of what needs action now and what can wait. With a well-thought-out approach, you can balance short-term needs with long-term aspirations.

Here is a guide to how you can begin investment prioritisation:

Step 1: List and Categorise Your Goals

Start by writing down all your goals and be specific rather than general. For instance, instead of "save money for the future", make it a SMART goal like: "save 10 lakhs for a child's degree fees in 3 years". When your goals are clear, it supports better decision-making. It also helps to separate your goals into buckets:

- Short-term goals: Are your goals you are planning up to 3 years (e.g., building an emergency fund, planning a holiday)

- Medium-term goals: These goals can range from 3-7 years (e.g., buying a vehicle, higher education expenses, planning a wedding)

- Long-term goals: You goals which you have more than 7 years to save for (e.g., retirement planning, buying a house)

When you categorise them, it makes investment prioritisation structured and realistic. You may use these financial goal examples to clarify how goals typically fit in each category.

Step 2: Identify Essential vs. Aspirational Goals

You need a list of all your goals and categorise them as not all goals are at priority. Some are essential for future financial security, while others are wants and lifestyle driven.

- Essential goals Is the money that you save for future needs, like emergency funds, health and life insurance coverage, and education.

- Aspirational goals include luxury purchases, vacations, or upgrading to a bigger home sooner than required.

When you are prioritizing investments, all your essential goals naturally will rank higher. As, aspirational goals can be planned with flexibly without affecting your long-term financial stability.

Step 3: Set Realistic Timelines and Cost Estimates

Once your goals are sorted, ask:

- How much will each goal cost?

- How much time do I have?

- What amount can I contribute to this goal regularly?

For example, planning for retirement over 25 years requires a different strategy from saving for a child's school admission next year.

This exercise is crucial for financial goal setting and makes investment prioritization far more precise. It also helps you understand if a goal is achievable with your current income or if adjustments are required.

Step 4: Build a Savings Priority List

A savings priority list helps you visually understand the order in which your goals need attention. Here is what you can use to start with:

- Emergency fund

- Health and life insurance

- Short-term essential goals

- Long-term wealth-building goals

- Aspirational goals

Many people find this hierarchy to support disciplined planning and help avoid situations where urgent needs derail long-term plans. Adding this layer strengthens your investment prioritisation efforts.

Step 5: Allocate Funds Based on Time Horizon and Risk Capacity

Each goal requires a different investment approach. For shorter-term goals, people often prefer low-volatility options, while longer-term goals allow room for growth-focused investments. Your investment prioritisation becomes practical and sustainable in the long run when you have a strategy.

Step 6: Review and Adjust Periodically

Life changes, your income may grow, new responsibilities may arise, or some goals may become irrelevant. A regular review keeps your plan updated and effective. During reviews, ask yourself these questions:

- Are your contributions sufficient?

- Has the cost of the goal changed?

- Do you need to reprioritise based on new circumstances?

Use this like a checklist during periodic assessment, it will help your investment prioritization remains aligned with your evolving needs.

Step 7: Avoid Overstretching Yourself

While it is tempting to work on several goals at once, overcommitting may affect your financial stability. It is acceptable to pause or adjust certain goals if your current budget becomes tight.

Remember, effective investment prioritization is not about chasing every goal simultaneously; it is about balancing ambition with affordability.

Conclusion

Managing multiple goals is possible when you carefully plan them, set realistic timelines, and clear categorisation. You can create a structure that will reflect your priorities and financial capacity. Investment prioritisation helps ensure that your needs are met, long-term goals stay on track, and aspirational goals are approached with clarity. By reviewing your plan regularly and adjusting as required, you build confidence in your journey towards better financial decision-making.

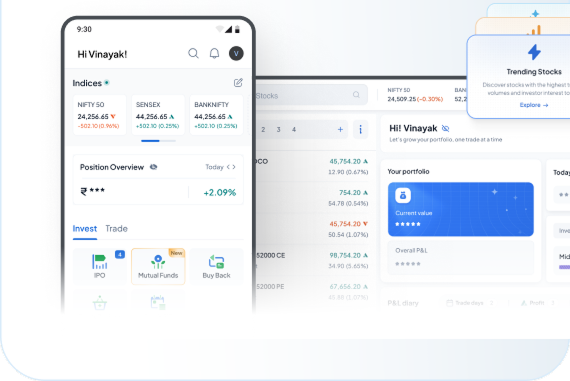

If you wish to explore tools and resources that can support your financial planning journey, you may visit the official digital platforms of Indiabulls Securities Limited (formerly known as Dhani Stocks) for educational insights.

FAQs

1. Can I work on long-term and short-term goals at the same time?

Yes, you can, provided your essential short-term needs are secure. After that, you can divide your contributions based on what is comfortable and sustainable for you.

2. How do I know if a goal is realistic?

Check if the required monthly contribution fits your current budget. Also consider time horizon, inflation, and market conditions before committing.

3. Should I change my priorities if my income increases?

You can. Higher income may allow faster progress or even room for new goals. It is useful to review your plan whenever there is a major financial change.

4. What if unexpected expenses affect my ongoing goals?

This is common. You may pause or reduce contributions temporarily and resume once your finances stabilise. Keeping an emergency fund helps reduce such disruption.

Disclaimer: The contents herein are only for information and do not amount to an offer, invitation or solicitation to buy or sell securities or any other financial product offered by Indiabulls Securities Limited (formerly Dhani Stocks Limited / DSL). The content mentioned herein is subject to updation, completion, amendment without notice and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject Indiabulls Securities Ltd. (formerly Dhani Stocks Ltd. / DSL) to any licensing or registration requirements. No content mentioned herein is intended to constitute any investment advice or opinion. ISL disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein. This blog is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made about its accuracy or its completeness is guaranteed. This content mentioned in this blog is solely for informational purpose and shall not be used and/or considered as an offer or invitation or solicitation to buy or sell securities or other financial instruments. ISL will not treat recipients as customers by virtue of their receiving this report. The securities / Mutual Fund units (if any) discussed and opinions expressed in this blog/report may not be suitable for all investors. Such investors must make their own investment decisions, based on their investment objectives, financial positions and specific needs. ISL accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. ISL may have issued other blogs that are inconsistent with and reach different conclusion from the information presented in this blog.

Indiabulls Securities Limited (formerly Dhani Stocks Limited) is a Mutual Fund Distributor registered with ‘Association of Mutual Fund of India’ (AMFI) vide ARN number ARN-160411. Corporate Identification Number: U74999DL2003PLC122874; Registered office address: A-2, First Floor, Kirti Nagar, New Delhi - 110008. Tel.: 011-41052775, Fax: 011-42137986.; Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase - I, Gurugram - 122016, Haryana. Tel: 022-61446300. Email: helpdesk@indiabulls.com