Financial Planning 101

Investing for Life Milestones: Marriage, Education, and Retirement

Dec 04, 2025

As you go through life, you get important milestones, and some bring new responsibilities for which you need to be financially prepared and commitments. Events such as marriage, children's education, and retirement require thoughtful planning well in advance. While these goals may appear very different, one thing connects them: the need for a long-term investing strategy that helps you stay financially prepared.

Planning early allows your money the time it needs to grow, helps you manage risks better, and reduces financial stress when these milestones approach. This blog explains how you can organise your finances for three major goals using a structured and practical approach.

Planning early allows your money the time it needs to grow, helps you manage risks better, and reduces financial stress when these milestones approach. This blog explains how you can organise your finances for three major goals using a structured and practical approach.

Every major life milestone requires a financial plan that supports future needs. A long-term investing strategy allows you to set clear timelines, estimate future expenses, and allocate money gradually. Since these goals often span many years, the longer you remain invested, the more you benefit from compounding.

A well-thought-out approach also helps you distribute your resources effectively across multiple goals. For instance, you may be planning for your wedding, setting aside funds for a child's education, and preparing for retirement at the same time. Managing all these priorities becomes easier when guided by a structured long-term investing strategy.

1. Planning for Marriage

Marriage is often the first major milestone for young adults. The associated expenses, professional photography, venue arrangements, travel, jewellery, and future home arrangements, can add up quickly. Preparing for this early helps prevent financial strain.

Estimate Your Expenses

You can start by listing out expected costs. It gives you a realistic financial target to work towards. Even if the event is a few years away, having an estimate helps shape your long- term investing strategy.

Start Investing Systematically

Instead of depending on last-minute loans or depleting savings, set aside small amounts across financial instruments suited to your risk appetite and timeline. Some individuals consider options like systematic investment plans, recurring deposits, or a portfolio based on best long-term investing principles.

Keep Flexibility in Mind

Your plans may evolve, change over time, venue changes, travel plans, or your preferences change, so maintaining an investment approach that allows flexibility is helpful. A diversified method that aligns with a broader long-term investing strategy ensures you stay prepared for changing needs.

2. Saving for Children's Education

Education costs have been rising steadily, and getting an education from a reputable institute matters. If you are planning your child's cost of education from school to university, or overseas studies, starting early makes a difference.

Calculate Future Costs

College or professional course fees can vary widely depending on the country, institution, and specialisation. You can use the current costs as a base and account for inflation for each year. This will give you an estimate and become the foundation of your long-term investing strategy.

Choose Suitable Investment Options

Education often requires a time horizon of 10-18 years. A thought-out approach can help balance risk and returns. While investing, many consider asset classes that align with long- term investing in stocks or goal-oriented funds to accumulate the required amount.

Review and Adjust Regularly

Children's aspirations will change as they grow. Revisiting your investment plan every year ensures your approach remains relevant and continues to reflect your broader long-term investing strategy.

3. Building a Retirement Corpus

Retirement is a long-term financial goal you have to plan for. It requires careful preparation as it determines your financial independence in your later years.

Estimate Post-Retirement Expenses

Think about the lifestyle you want after retirement, travel, healthcare, hobbies, or relocation. Calculating expected monthly expenses helps identify the amount you need to accumulate. A disciplined long-term investing strategy ensures you remain on track over multiple decades.

Start Early for More Growth

When you start with even small contributions made consistently over a long period can grow significantly due to compounding. Many people invest their money in diversified portfolios, retirement-focused schemes, and other instruments that support long-term trading of stocks or long-horizon planning.

Keep Risk Exposure Balanced

As retirement approaches, gradually shifting towards stable and predictable investment options can help preserve capital. At the same time, maintaining some growth-oriented exposure may be necessary to handle inflation. The right mix will depend on age, income, dependents, and personal preferences, yet all of it should align with your overall long-term investing strategy.

How to Prioritise Multiple Life Goals

Many individuals find themselves planning for more than one milestone at a time. Here's how you can manage them effectively:

Categorise Your Goals

- Short-term: Less than 3 years

- Medium-term: 3-7 years

- Long-term: More than 7 years

Marriage may fall into the medium-term category, education typically into the long-term category, and retirement into the very long-term category.

Allocate Funds Based on Time Horizon

The longer the time you invest your money, the more it will compound and can work in your favour. This principle forms the core of a strong long-term investing strategy, helping you prioritise accordingly.

Review Your Plan Annually

Life situations can change, salary increases, health needs, or lifestyle shifts. Adjusting your investments ensures your financial planning remains aligned with your goals. A flexible long-term investing strategy adapts to these changes smoothly and keeps you focused on long-term success.

Conclusion

Life milestones are moments of joy, responsibility, and new beginnings. Whether you are planning for a marriage, building an education fund, or preparing for retirement, consistency and early action can help you stay financially ready. A structured long-term investing strategy not only supports these goals but also brings peace of mind as you move through different stages of life.

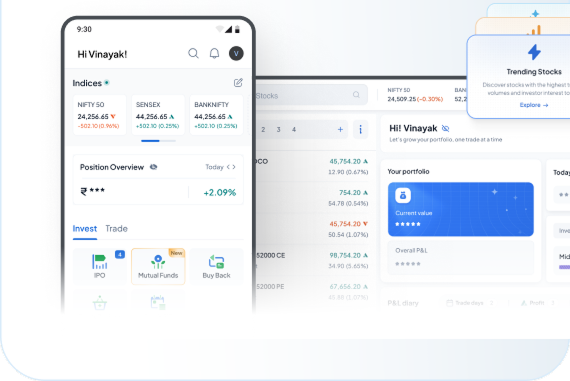

If you are looking to organise your financial goals effectively, you may explore the tools and resources offered by Indiabulls Securities Limited (formerly known as Dhani Stocks Limited). Our platforms provide information, research materials, and features that can support you in making educated decisions that you can tailor to suit your long-term objectives.

FAQs

1. When should I start planning for retirement?

It is ideal to begin as soon as you start earning. The earlier you begin, the more time your investments have to grow, helping you build a stronger retirement corpus.

2. How often should I review my financial goals?

Reviewing your goals at least once a year is recommended to ensure your investments match your current financial situation and future plans.

3. Is it possible to save for multiple milestones at the same time?

Yes. With proper goal-based planning, you can allocate funds to different milestones based on their timelines and importance.

4. Do market fluctuations affect long-term planning?

Short-term fluctuations are common, but long-term goals generally focus on disciplined investing over several years, which helps balance temporary market movements.

Disclaimer: The contents herein are only for information and do not amount to an offer, invitation or solicitation to buy or sell securities or any other financial product offered by Indiabulls Securities Limited (formerly Dhani Stocks Limited / DSL). The content mentioned herein is subject to updation, completion, amendment without notice and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject Indiabulls Securities Ltd. (formerly Dhani Stocks Ltd. / DSL) to any licensing or registration requirements. No content mentioned herein is intended to constitute any investment advice or opinion. ISL disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein. This blog is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made about its accuracy or its completeness is guaranteed. This content mentioned in this blog is solely for informational purpose and shall not be used and/or considered as an offer or invitation or solicitation to buy or sell securities or other financial instruments. ISL will not treat recipients as customers by virtue of their receiving this report. The securities / Mutual Fund units (if any) discussed and opinions expressed in this blog/report may not be suitable for all investors. Such investors must make their own investment decisions, based on their investment objectives, financial positions and specific needs. ISL accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. ISL may have issued other blogs that are inconsistent with and reach different conclusion from the information presented in this blog.

Indiabulls Securities Limited (formerly Dhani Stocks Limited) is a Mutual Fund Distributor registered with ‘Association of Mutual Fund of India’ (AMFI) vide ARN number ARN-160411. Corporate Identification Number: U74999DL2003PLC122874; Registered office address: A-2, First Floor, Kirti Nagar, New Delhi - 110008. Tel.: 011-41052775, Fax: 011-42137986.; Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase - I, Gurugram - 122016, Haryana. Tel: 022-61446300. Email: helpdesk@indiabulls.com