Stock Market Basics

What Is an Nifty ETF and How Does It Work?

Jan 23, 2026

For many retail investors, equity investing can appear complex, especially when it involves tracking market indices. One commonly discussed option in this space is the Nifty Exchange Traded Fund (ETF). Before going further, it is important to know what is Nifty 50 ETF and how it functions in practice.

At its core, a Nifty ETF is designed to replicate the performance of the Nifty 50 Index, which represents 50 of India's largest listed companies by market capitalisation. It helps investors assess whether index-based investing suits their financial objectives and risk appetite.

Understanding the Nifty 50 ETF

To explain what is Nifty 50 ETF is, it helps to start with the index itself. The Nifty 50 Index includes companies across sectors such as banking, IT, energy, pharmaceuticals, and consumer goods. A Nifty 50 ETF invests in these same companies, maintaining similar weightings as the index.

This means when the Nifty 50 Index rises or falls, the ETF's value generally moves in the same direction. However, ETF returns may vary from the value of the index because of the expenses and transaction costs, a difference known as tracking error.

- It passively tracks the Nifty 50 Index

- It is traded on stock exchanges like listed shares

- It offers exposure to multiple sectors through one instrument

- It carries lower expense ratios compared to actively managed equity funds

Understanding what is Nifty 50 ETF is also involves recognising that these funds do not attempt to outperform the market. Instead, they aim to mirror index performance over time.

How Does a Nifty ETF Work in Practice?

To grasp What is Nifty 50 ETF, investors must also understand the operational mechanism behind it. ETFs are handled by Asset Management Companies (AMCs), which create and redeem ETF units based on market demand.

How Nifty the ETF works

- The AMC purchases shares of all Nifty 50 companies in index proportion

- ETF units are created and listed on the stock exchange

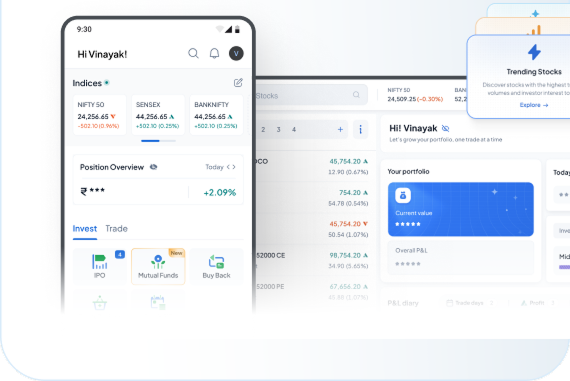

- Investors buy and sell units through their demat and trading accounts

- The ETF portfolio is periodically rebalanced to match index changes

This explains how Nifty ETF works without the need for active stock selection by the investor. The structure allows investors to participate in market movements without directly buying individual shares.

Example

If an investor buys units of a Nifty ETF and the Nifty 50 Index rises by 10% over a year, the ETF value may rise by approximately 9.8-9.9%, accounting for expenses and tracking error. Understanding what is Nifty 50 ETF is through examples highlights its simplicity for long- term market participation.

If an investor buys units of a Nifty ETF

If an investor buys units of a Nifty ETF

| Feature | Nifty 50 ETF | Actively Managed Equity Fund | Direct Equity |

|---|---|---|---|

| Management style | Passive | Active | Self-managed |

| Expense ratio | Generally lower | Higher | Brokerage-based |

| Diversification | High (50 stocks) | Varies | Depends on the investor |

| Market tracking | Mirrors Nifty 50 | May outperform or underperform | No index linkage |

| Trading method | Stock exchange | AMC platform | Stock exchange |

This comparison clarifies why investors exploring What is Nifty 50 ETF is often view it as a cost-efficient way to gain diversified market exposure.

Benefits and Limitations of Nifty ETFs

To have a full picture of what Nifty 50 ETFs are, you also need to know how to weigh advantages and limitations.

Potential benefits

- Broad exposure to large-cap companies

- Lower costs due to passive management

- Transparency, as holdings mirror a public index

- Liquidity through exchange trading

Limitations to consider

- No downside protection during market declines

- Returns capped to index performance

- Small tracking differences may arise

- Requires a demat and trading account

Even the best Nifty 50 ETF will be subject to overall market risk, as it cannot avoid downturns in the index.

Who Typically Considers Investing in Nifty ETFs?

An understanding of What is Nifty 50 ETF becomes more practical when aligned with investor profiles.

Nifty ETFs are often considered by:

- First-time equity investors who want to diversify their capital

- Long-term investors aiming to match market returns

- Investors preferring low-cost, rule-based investing

- Individuals using ETFs for asset allocation

However, they may not suit investors seeking short-term gains or active stock selection strategies.

Conclusion

Understanding Nifty 50 ETF can give you clarity on how passive index investing works and why it has gained attention among retail investors. These ETFs offer diversified exposure, cost efficiency, and transparency, while remaining subject to market risks by mirroring the Nifty 50 Index.

Learning What is Nifty 50 ETF is can be a practical starting point for investors in the equity markets without actively managing individual stocks.

To explore ETFs, indices, and market-linked instruments in more detail, consider reviewing educational resources and market insights available through Indiabulls Securities Limited (formerly Dhani Stocks Limited).

Disclamier

“Refer to the Risk Disclosure Document to know the risks associated with F&O Trading.”

FAQs

1. Can Nifty ETFs be bought without a demat account?

No. Since ETFs are traded on stock exchanges, a demat and trading account is required to buy or sell them.

2. Do Nifty ETFs pay dividends?

Dividends received from underlying companies may be reinvested or distributed, depending on the ETF structure and scheme terms.

3. Is timing the market important for Nifty ETFs?

Nifty ETFs are generally used for long-term exposure. Short-term timing plays a limited role compared to disciplined investing.

4. Are Nifty ETFs suitable for systematic investing?

Some investors use ETFs alongside periodic purchase strategies, but execution depends on market liquidity and brokerage mechanisms.

Disclaimer: The contents herein are only for information and do not amount to an offer, invitation or solicitation to buy or sell securities or any other financial product offered by Indiabulls Securities Limited (formerly Dhani Stocks Limited / DSL). The content mentioned herein is subject to updation, completion, amendment without notice and is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to law or would subject Indiabulls Securities Ltd. (formerly Dhani Stocks Ltd. / DSL) to any licensing or registration requirements. No content mentioned herein is intended to constitute any investment advice or opinion. ISL disclaims any liability with respect to accuracy of information or any error or omission or any loss or damage incurred by anyone in reliance on the contents herein. This blog is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made about its accuracy or its completeness is guaranteed. This content mentioned in this blog is solely for informational purpose and shall not be used and/or considered as an offer or invitation or solicitation to buy or sell securities or other financial instruments. ISL will not treat recipients as customers by virtue of their receiving this report. The securities / Mutual Fund units (if any) discussed and opinions expressed in this blog/report may not be suitable for all investors. Such investors must make their own investment decisions, based on their investment objectives, financial positions and specific needs. ISL accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. ISL may have issued other blogs that are inconsistent with and reach different conclusion from the information presented in this blog.

Indiabulls Securities Limited (formerly Dhani Stocks Limited) is a Mutual Fund Distributor registered with ‘Association of Mutual Fund of India’ (AMFI) vide ARN number ARN-160411. Corporate Identification Number: U74999DL2003PLC122874; Registered office address: A-2, First Floor, Kirti Nagar, New Delhi - 110008. Tel.: 011-41052775, Fax: 011-42137986.; Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase - I, Gurugram - 122016, Haryana. Tel: 022-61446300. Email: helpdesk@indiabulls.com